AP Land Tax Know Your Dues, Self Assessment, Tax Exemption, Mutation, Revision Petition: Applicants can now easily avail the complete information about the land tax in the state of Andhra Pradesh. The authority i.e. Commissioner & Director of Municipal Administration have launched a website which contains all the relevant information regarding the payment of AP land tax. Applicants who have not yet paid their land tax can refer to the complete article where we have depicted all the essential features of the Andhra Pradesh land tax website i.e. cdma.ap.gov.in.

The services are for the people living in the state of Andhra Pradesh. All the services are provided under one portal on the official portal of the AP Land Tax i.e. cdma.ap.gov.in. The services to know your dues online along with self assessment, exemption from tax, mutation, revision petition, addition/alteration, download proceeding, special notice etc. can be easily availed from the portal. All the other steps to get the services can be easily extracted from the article below.

The portal not only provides help to check the status for various services along but also it helps to pay the taxes online. Now, the applicant does not have to stand in long queues for paying the taxes related to property. In this article, we have particularly discussed the services related to the land tax and the process to apply for the online payment of the taxes. Other topics such as Death, birth registration, Tree felling permission, Marriage registration will be discussed briefly in the next article.

AP Land Tax @cdma.ap.gov.in

The tax are collected by the state government from the owner who have the property in the area where the municipal authority is active. These taxes comes under the state government of Andhra Pradesh. The rate of the taxes are mentioned on the municipal rule book which can be availed online from the official portal. For the convenience of the applicants, we have provided below a quick overview of the taxes collected by the Municipal authority. The rate fixed for the land depends upon the circle rate persisting in the state. The value for the land tax in the state for Andhra Pradesh can be checked by visiting the official portal @ cdma.ap.gov.in

| Residential Property Annual Income limit | Rate of Property Tax |

| Up to Rs.600/- | Exempted |

| Rs.601/- to Rs.1200/- | 17% |

| Rs.1201/- to Rs.2400/- | 19% |

| Rs.2401/- to Rs.3600/- | 22% |

| Above Rs.3600/- | 30% |

Andhra Pradesh Land Tax Complete Overview

The detailed overview about the service portal in the state of Andhra Pradesh is provided below.

| Authority | Government of Andhra Pradesh |

| Official Portal | ap.gov.in |

| Service Portal Name | Commissioner & Director of Municipal Administration |

| Service Portal Web Address | cdma.ap.gov.in |

| Services Provided | Land tax, Property Tax, Trade License, Sewerage License |

| Mode to avail services | Online through visiting the official portal |

| Eligibility | Should have property in the State (in Municipality region) |

| Location | Andhra Pradesh |

List of services available in the Portal

The service portal provides various services other than the land tax valuation. The list of different other services which can be availed by the applicant residing in the state of the Andhra Pradesh are mentioned below.

- Property Tax,

- Land Tax,

- Water Charges,

- Common charges for Water and Sewerage,

- Trade License,

- Advertisement Tax,

- Online building/Layout permission,

- Birth and Death Registrations,

- Marriage Registration,

- Tress felling permission.

Essential Documents required

The documents varies for the service you are availing. For paying the online property tax, applicant need to know the details of their property. The same procedure accounts for paying the land, water tax etc. The list of some important which might be required so as to to register for the online services are-:

- Aadhar Card,

- PAN Card,

- Land/Property details,

- Previous month Electricity bill,

- Previously paid tax receipt,

- Highschool certificate,

- Voter id,

- Property map etc.

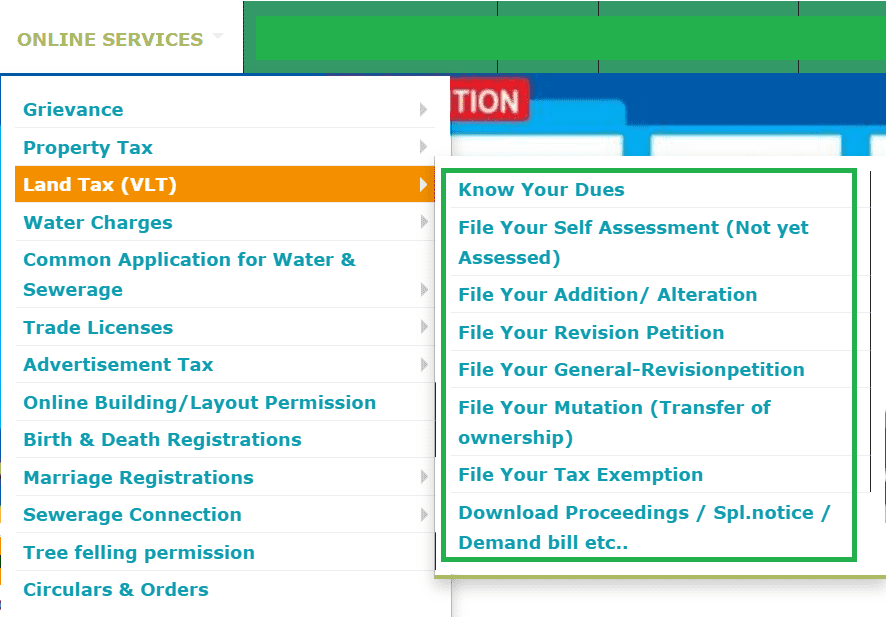

AP Land Tax Online Services @ cdma.ap.gov.in

The online tax can be paid by following the simple steps mentioned below.

- Start by visiting the official portal of the Commissioner & Director of Municipal Administration i.e. cdma.ap.gov.in|

- The homepage of the official portal will flash on the screen.

- On the homepage, tap on the Online Services on the menu bar of the homepage.

- Move the cursor Land Tax (VLT) under the drop down under the Online Services.

- Applicant will then find the list of various other services under the land tax (VLT) option.

- Applicant can have the detailed overview about all the services under the Land Tax option below.

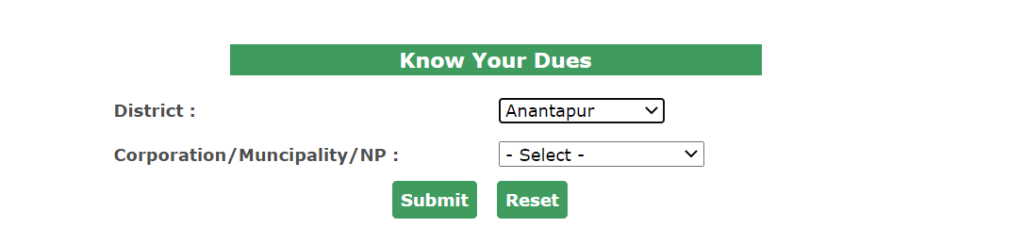

Know Your Dues

Applicant can get the details of the dues on their property/land through following the steps provided below.

- Follow the above procedure and as see option of Know your Dues under the Land Tax (VLT) and click on it.

- As you click on the link, a new window will appear on the screen.

- Select your District and Corporation/Municipality/NP and click on submit button.

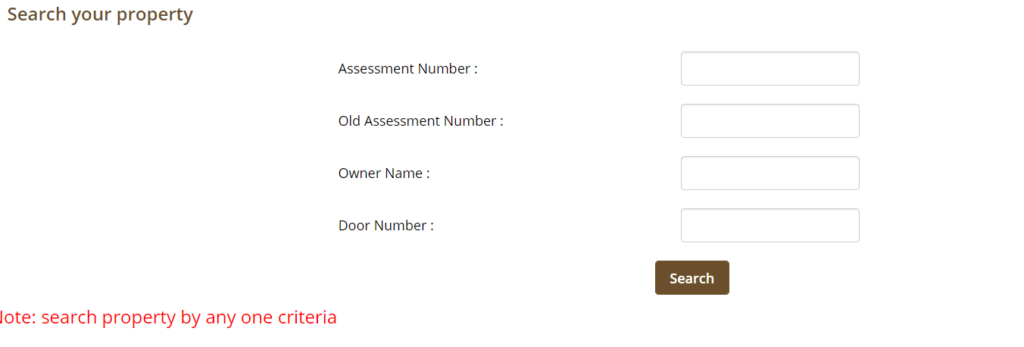

- The page will be redirected to the Property tax page where the applicant has to provide some of the important information to get the details of the dues on the property.

- From the criteria of Assessment Number, Old Assessment Number, Owner Name, Door Number. Select anyone and proceed further.

- After you click on the search button, the new page will appear showing the dues on your property.

- Applicant can pay the online tax through the steps mentioned in the article below.

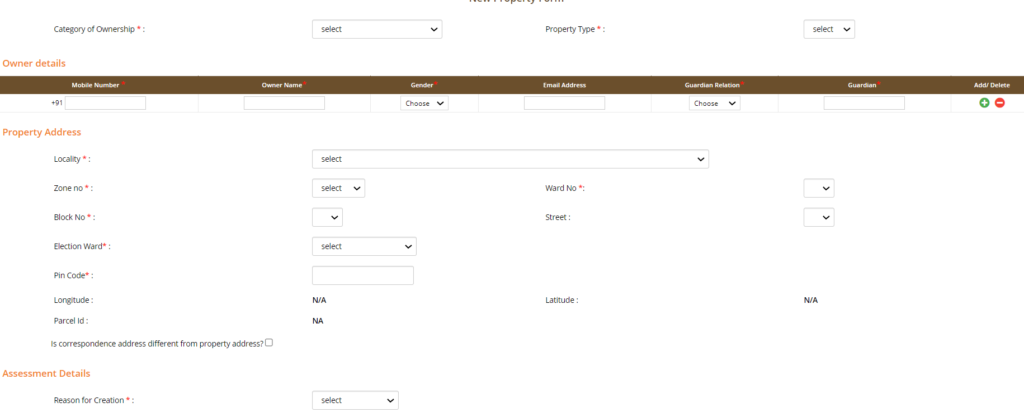

How to file Self Assessment (Property Registration)?

The applicant can apply for the self assessment online through the visiting the official of the authority. The self assessment is like the new registration for the property. Self assessment can be done offline through visiting the CSC/ Me Seva in the region. To apply online for the service please refer to the complete steps given below.

- As you have the list of option on the screen under the Land tax (VLT), tap on the File your Self Assessment.

- The page will appear where yo have to select your District and Corporation/Municipality/NP.

- Tap on the search button after select the details.

- Applicant will then have the property registration form in front of them.

- Select the ownership and property type of the land.

- Applicant can take help from concerned person who knows the terminology used in the application form.

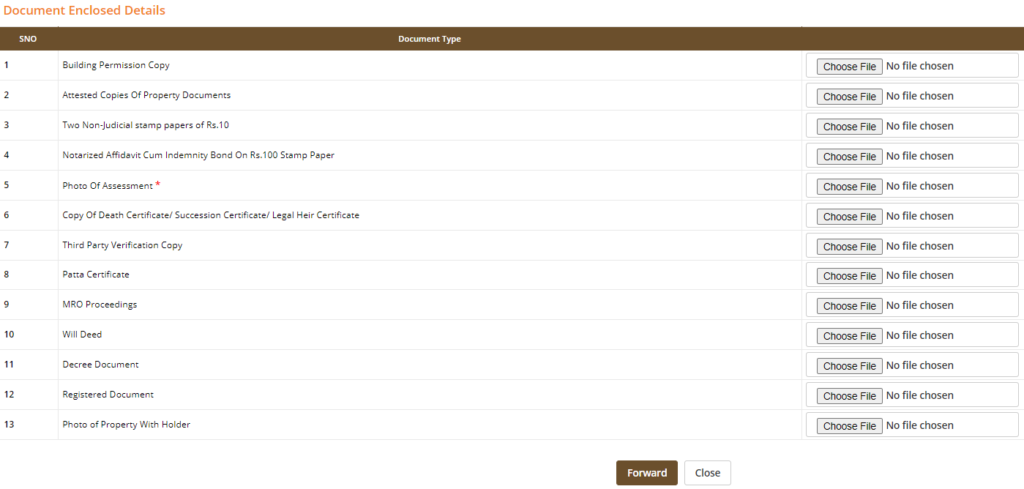

- After entering the basic details applicant has to upload the list of documents asked on the application form.

- The list of 13 documents required for upload are given below.

- Please note that the Photo of Assessment is mandatory.

How file Addition/Alteration?

In order to make changes to the land records applicant needs to have their assessment number through which the addition/alteration of the entities can be made. In case the applicant buys another property which is not listed in the applicant, then through the additional tools provided in the portal applicant can add the property details on the portal. The same process imply with the Alteration which allows the applicant to remove the property from the dashboard which is not in the name of the applicant holding that account.

Please refer to the links at the end of the page to get the important links related to the addition and alteration of the entities.

Applicants can visit the CSC centres if they face any problem in filing the addition/alteration against the records mentioned on the official portal.

How to file revision petition?

- Applicant has to visit the official portal of the Commissioner & Director of Municipal Administration i.e. cdma.ap.gov.in|

- Select the online services and move the cursor to the land tax.

- From the various option that appears on the screen, select File your Revision Petitions.

- Same screen as discussed in above paragraphs will appear on the screen.

- After selecting the District and Municipal region, the new page will appear where you have to enter your assessment number.

- After this you will redirected to the dashboard.

- Select the revision petition and forward it to the concerned authority.

- Please refer to the attached video below to get the instruction to know about how to file the revision petition.

How to file your Mutation (Transfer of Ownership)?

Applicant can file the mutation through the same procedure as provided in the above paragraphs. The mutation means the transfer of ownership. The seller has to change the details in the name of the new owner to the property. Applicant need to have assessment number through which they can enter to the dashboard and edit the ownership details. The direct links to file the mutation online on the AP Land tax portal are provided at the end of the page.

Applicant can approach to the CSC to apply for the service. Applicant must have the following list of documents with them which includes Address proof, registered title deed, and some id verification documents (Aadhar, PAN etc.) of both parties.

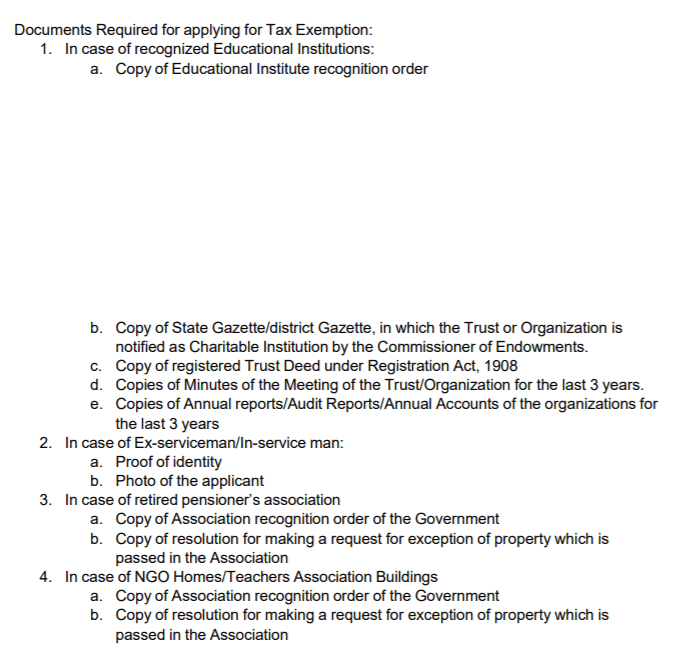

How to file tax exemption?

The service can be availed by some of the beneficiaries in the state belonging to the category of senior citizens, Educational Institutions, Charitable institutions, Ex-serviceman/In-service man, retired pensioner’s association, NGO Homes/Teachers Association Buildings only. The tax exemption can be availed online through the portal. Applicant have to file the tax exemption request and the authority after checking all the documents will then notify about the tax exemption for the applicant. The steps to file tax exemption are-:

- Tap on the links here i.e. cdma.ap.gov.in/en/taxexemption.

- You will be directed to the tax exemption page.

- Select your district and Corporation/Municipality/NP.

- Now on the new screen that appears on the screen provide the assessment number.

- Applicant has to fill the form which will have following details i.e.-:

- Floor No.,

- Classification of Building,

- Residential/Non- Residential,

- In case of NR detailed usage

- Firm Name,

- Owner name,

- Occupant name,

- Date of construction.

- After filling the details applicant has to upload the relevant documents asked on the application form.

- The list of document are as follows-:

Important Links

| Know your Dues | Click Here |

| File your Self Assessment | Click Here |

| File your Addition/ Alteration | Click Here |

| File your Revision petition | Click Here |

| File your General Revision petition | Click Here |

| File your Mutation (Transfer of Ownership) | Click Here |

| File your Tax Exemption | Click Here |

| Download Proceeding/ Special Notice | Click Here |

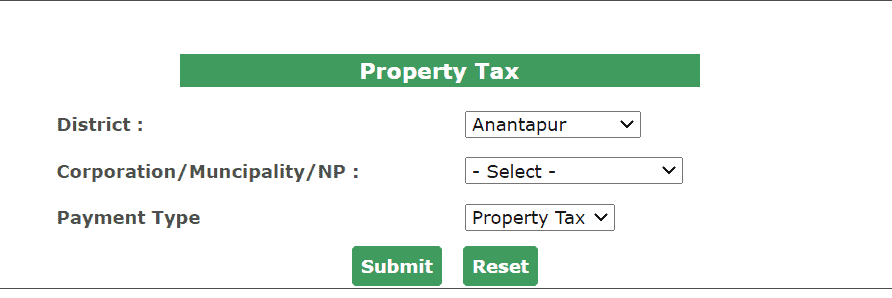

How to pay property tax online?

Applicants can pay their taxes online through the portal. The applicant firstly needs to check the active dues on the property through Know your dues from the online service in the portal. After you have checked your dues status, please refer to the steps below

- Visit the official portal of the Commissioner & Director of Municipal Administration i.e. cdma.ap.gov.in

- After you reached the homepage of the official portal, tap on the Online Payment tab.

- A drop down will appear on the screen.

- Select the first option Property Tax.

- As you click on the link the new page will appear on the screen where you have to select your district, Corporation, and mode of Payment.

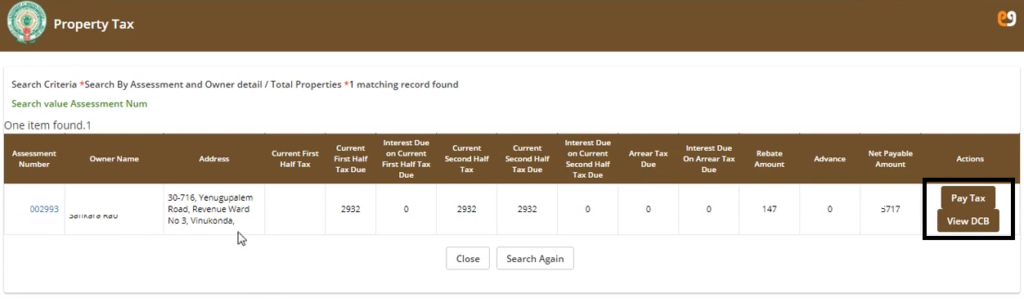

- Now enter Assessment Number, Old Assessment Number, Owner Name, Door Number. Select anyone and proceed further.

- After entering the details tap on the search details and the amount of the property tax will appear on the screen.

- Tap on the Pay Tax as shown in the image below.

- As you click on it, you will be directed to the new tab where you can easily pay the property tax.

- The online tax can be paid by credit card, debit card and other means of online payment.

- Do not forget to print the receipt after successful payment of the tax.

The same process is to be followed for the online payment of the other services provided in the official portal. The list of other services provided in the portal are-:

Water Charges

Trade License Fees

Sewerage Charges

Leases & Agreement Fees

Property Mutation Fees

Advertisement tax

Subsidy on Property/ Land Tax

The authority provides some amount of rebate on the tax paid by the applicants. The rebate are of two type which are given on the taxes. The first one is of the subsidy type on which some percent of the rebate is given to the applicants who register before the deadline given by the authority. After the deadline is over the subsidy provided on the tax becomes null and invalid.

The second type of rebate is generally provided on the property which totally depends upon the age of the structure. The percentage of rebate given on the tax is directly proportional to the age of the structure. As the age of the structure increases the deduction provided on it also increases. The maximum deduction of 30% is allowed on the tax. Please refer to the table below to know more

| Structure Age | Rebate Given |

| 25 years and below | 10% of ARV |

| Above 25 years and up to 40 years | 20% of ARV |

| Above 40 years | 30% of ARV |

Penalty

Along with giving rebates on the tax payment, the authority also charges penalty for the late submission of the taxes. However, the authority provides much time to the applicant for submitting the taxes annually but if the applicant is unable to pay the taxes before the last date they have to pay a fine with the tax. Also no rebate shall be given on the tax payment which are done after the last date of the payment. The details of the dates can be known through visiting the know your dues section on which the amount of the due along with the last date is mentioned.

FAQs

The applicant refer to the direct links and have to fill the application form in order to get the details of dues on my property.

The list of documents that are needed to be uploaded on the registration form are as follows-:

Photo of Property /Land

Two non-judicial stamp papers of Rs.10/- each

Attested copies of Property documents

a. Patta certificate

b. Decree document

c. Will deed

d. MRO Proceedings

e. Registered document

Copy of death certificate/succession certificate/legal heir certificate

Any other document

Revision petition can be availed by the applicant if they have any of the query regarding the tax. If the applicant feels that the authority is charging excess of tax, then they can file the revision petition. Applicants can refer to the steps provided in the article to file aa revision petition.

Tax exemption can only be availed by the applicant belonging to the specific categories of Senior citizen, Education, Ex- Servicemen, Retired personals, NGO etc.

Applicant can visit the Mee Seva/csc centre with complete documents to avail the services given under the official portal of Commissioner & Director of Municipal Administration.

Applicant can login with the Assessment Number/Old Assessment Number/Owner Name/Door Number.

The total rebate of 10% to 20% will be given on the tax. The amount of the tax waived off by the authority can be known through checking the due status from the official portal.